Some Known Factual Statements About Mileage Tracker

Table of Contents7 Simple Techniques For Mileage TrackerThe Greatest Guide To Mileage TrackerThe Mileage Tracker PDFsThe 5-Second Trick For Mileage TrackerSee This Report about Mileage TrackerThe Ultimate Guide To Mileage Tracker

%20(1).webp)

A web-based organizer ought to have the ability to offer you a quite exact quote of gas mileage for the journey concerned. While it might look like a difficult task, the benefits of maintaining an automobile gas mileage log are significant. As soon as you get right into the behavior of tracking your gas mileage, it will come to be 2nd nature to you.

Our notebooks are made utilizing the greatest top quality materials. If you have any kind of questions, do not be reluctant to get to out - email us at!.

For tiny business owners, tracking mileage can be a tiresome yet important job, especially when it pertains to maximizing tax deductions and controlling overhead. The days of by hand taping mileage in a paper log are fading, as electronic gas mileage logs have made the process a lot more effective, precise, and hassle-free.

Some Known Facts About Mileage Tracker.

One of one of the most considerable benefits of making use of a digital mileage log is the moment it saves. With automation at its core, electronic devices can track your trips without needing hands-on input for each trip you take. Digital mileage logs utilize general practitioner technology to automatically track the range took a trip, classify the journey (e.g., business or individual), and produce in-depth records.

The app does all the job for you. Time-saving: Conserve hours of hands-on data entry and avoid human errors by automating your mileage logging procedure. Real-time monitoring: Instantaneously track your miles and produce records without waiting until the end of the week or month to log journeys. For tiny business proprietors, where time is money, using an electronic mileage log can substantially simplify daily procedures and free up more time to concentrate on growing the business.

Some business proprietors are vague concerning the advantages of tracking their driving with a gas mileage application. In a nutshell, tracking mileage during business traveling will help to increase your fuel performance. It can additionally aid minimize automobile wear and tear.

Examine This Report about Mileage Tracker

This post will expose the advantages related to leveraging a gas mileage tracker. If you run a distribution company, there is a high chance of investing lengthy hours when driving daily. Local business owner typically locate it difficult to track the distances they cover with their lorries considering that they have a whole lot to consider.

In that case, it implies you have all the opportunity to enhance that element of your organization. When you use a gas visit this site mileage tracker, you'll have the ability to tape-record your costs much better. This helps your total monetary records. You 'd be able to decrease your expenditures in certain areas like tax obligations, insurance policy, and vehicle wear and tear.

Gas mileage monitoring plays a big function in the lives of lots of vehicle drivers, workers and company choice manufacturers. What does gas mileage tracking mean? And what makes a mileage tracker app the ideal mileage tracker application?

About Mileage Tracker

Mileage monitoring, or gas mileage capture, is the recording of the miles your drive for organization. Many permanent staff members or agreement workers tape their mileage for repayment purposes.

It's essential to keep in mind that, while the device utilizes general practitioners and movement sensing unit abilities of the phone, they aren't sharing locations with employers in real time - mileage tracker. This isn't a surveillance initiative, yet an easier method to record business journeys took a trip accurately. A free mileage capture app will certainly be tough to find by

The 8-Second Trick For Mileage Tracker

Gas mileage applications for private chauffeurs can cost anywhere from $3 to $30 a month. We imp source recognize there are a great deal of employees out there that require an app to track their gas mileage for tax and compensation objectives.

There are a significant number of benefits to making use of a gas mileage tracker. For companies, it's IRS conformity, boosted presence, lowered gas mileage fraudulence, minimized management. For service providers, it's mainly concerning tax reduction. Allow's check out these benefits additionally, beginning with among one of the most important reasons to apply a gas mileage monitoring app: IRS compliance.

Expense compensation fraudulence make up 17% of service expenditure fraudulence. Usually, that scams is directly associated with T&E products. Lots of companies are simply unaware of the fraud since their procedures are incapable to examine reports in an automated, efficient fashion. With an automatic mileage tracking app, companies obtain GPS-verified gas mileage logs from their workers.

How Mileage Tracker can Save You Time, Stress, and Money.

A good mileage monitoring app gives all the above. Yet the most effective includes a team accountable for gathering the gas mileage information, taking care of compensations and providing understandings into your workforce. Automating gas mileage tracking improves performance for those in the field and those busy filling up out the logs. With a mileage app, logs can easily be sent for repayment and maximize the management work of confirming all staff member gas mileage logs.

Once again, service providers mostly make use of his explanation organization mileage trackers to track their gas mileage for tax obligation reductions. Yet some gas mileage trackers are far better than others. What makes the best gas mileage tracker application? Here are a few methods that specific apps establish themselves over the remainder. Automated mileage tracking advantages the firm and its staff members in countless means.

Marcus Jordan Then & Now!

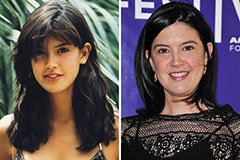

Marcus Jordan Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!